Latest News

Via MarketBeat · February 10, 2026

There are some very complex dynamics currently at play in the stock market.

Via The Motley Fool · February 10, 2026

Shares of semiconductor materials supplier Entegris (NASDAQ:ENTG) jumped 10.2% in the afternoon session after the company reported fourth-quarter results that beat analyst expectations and provided a strong forecast for the first quarter of 2026.

Via StockStory · February 10, 2026

Shares of independent financial services firm LPL Financial (NASDAQ:LPLA) fell 9.8% in the afternoon session after fears of industry disruption grew as wealth management startup Altruist introduced AI-enabled tax planning features, sparking a selloff in U.S. brokerage stocks.

Via StockStory · February 10, 2026

Shares of cloud security and performance company Cloudflare (NYSE:NET) jumped 5% in the afternoon session after investor optimism grew ahead of its fourth-quarter 2025 earnings report, which was scheduled for release after the market close, fueled by the company's expanding role in artificial intelligence.

Via StockStory · February 10, 2026

Shares of beauty and waxing service franchise European Wax Center (NASDAQ:EWCZ) jumped 42.6% in the afternoon session after the company agreed to be acquired and taken private by investment firm General Atlantic for $5.80 per share in an all-cash deal.

Via StockStory · February 10, 2026

Shares of online work marketplace Upwork (NASDAQ:UPWK)

fell 16.6% in the afternoon session after the company issued disappointing financial guidance for the upcoming quarter and reported a drop in a key user activity metric. The company's revenue forecast for the first quarter of 2026 was $194.5 million at the midpoint, falling 3.1% short of Wall Street's estimates. Adding to investor concerns, Upwork's Gross Services Volume, a measure of activity on the platform, declined by 5.6% year-over-year to 785,000. This weak outlook overshadowed the company's fourth-quarter results, which had beaten analysts' expectations. For the quarter, Upwork reported sales of $198.4 million and an adjusted profit of $0.36 per share, which was 15.5% above consensus estimates.

Via StockStory · February 10, 2026

Shares of interactive software platform Unity (NYSE:U) jumped 4.5% in the afternoon session after Oppenheimer upgraded its rating on the stock to Outperform from Perform, citing improving fundamentals and dismissing fears about competitive threats from AI.

Via StockStory · February 10, 2026

Shares of food and facilities services provider Aramark (NYSE:ARMK) jumped 4.5% in the afternoon session after the company reported mixed fourth-quarter results but offered an optimistic earnings forecast for the upcoming year.

Via StockStory · February 10, 2026

Shares of analog chips maker onsemi (NASDAQ:ON)

jumped 3.1% in the afternoon session after the company reported mixed fourth-quarter results where earnings per share beat analyst estimates, but revenue guidance for the upcoming quarter fell short. The analog chip maker posted an adjusted EPS of $0.64, beating the consensus estimate of $0.62. Revenue came in at $1.53 billion, in line with expectations but representing an 11.2% decline from the previous year. However, the positive earnings surprise was tempered by the company's forecast for the first quarter, which projected both revenue and earnings below Wall Street's projections. Despite the weak outlook, investors appeared to focus on the better-than-expected profit and a strong free cash flow margin of 31.7% for the quarter. The stock's rally represented a significant reversal from an initial 4.6% drop immediately following the earnings release, suggesting a shift in sentiment as the market digested the full report.

Via StockStory · February 10, 2026

Shares of financial services giant Charles Schwab (NYSE:SCHW) fell 6.9% in the afternoon session after the launch of a new artificial intelligence tool by financial software provider Altruist sparked concerns about disruption in the wealth management sector. The tech platform announced a new AI-powered tax planning tool, which triggered a selloff across several wealth management stocks. The news raised worries that artificial intelligence could upend the traditional business models of financial services firms. Other companies in the sector, including Raymond James Financial and Stifel Financial, also saw their stock prices fall as investors reacted to the potential competitive threat posed by new technology.

Via StockStory · February 10, 2026

Shares of electronic components manufacturer CTS Corporation (NYSE:CTS) jumped 4.2% in the afternoon session after the company reported fourth-quarter 2025 results that topped analyst expectations for revenue and profit.

Via StockStory · February 10, 2026

Shares of database platform company MongoDB (NASDAQ:MDB) jumped 6.4% in the afternoon session after a positive research note from Goldman Sachs eased investor concerns about the potential disruption from artificial intelligence. The investment bank's analysis concluded that MongoDB's business benefited from "durable economics, mission-critical platform roles and tangible AI product innovation." The note suggested these factors provided the company with insulation during a period of uncertainty. Goldman Sachs maintained a constructive outlook, stating that there were "credible paths for AI to reinforce rather than undermine long-term growth" for the software company. The rally also occurred amid a broader advance in technology stocks, which saw the Nasdaq Composite index climb.

Via StockStory · February 10, 2026

Shares of financial services firm Raymond James Financial (NYSE:RJF) fell 8.8% in the afternoon session after concerns grew that new artificial intelligence tools could disrupt the traditional financial advisory business.

Via StockStory · February 10, 2026

Shares of financial intelligence company S&P Global (NYSE:SPGI) fell 9.7% in the afternoon session after its fourth-quarter 2025 earnings fell short of Wall Street's expectations.

Via StockStory · February 10, 2026

Shares of diversified manufacturing and supply chain services provider Park-Ohio (NASDAQ:PKOH)

jumped 8.5% in the afternoon session after KeyBanc upgraded the industrial company's stock to Overweight from Sector Weight and set a price target of $37. The upgrade was based on the analyst firm's expectation for an upswing in the industrial market. KeyBanc noted that this potential upcycle could benefit Park-Ohio if the company successfully executed its internal plans. The new price target represented a 48% premium over the stock's price at the time of the report, signaling strong confidence in its future performance.

Via StockStory · February 10, 2026

Shares of go-to-market intelligence provider ZoomInfo (NASDAQ:GTM) fell 6.4% in the afternoon session after the company issued a weak financial forecast for 2026, which overshadowed its fourth-quarter earnings beat and led to at least one analyst downgrade. While ZoomInfo reported fourth-quarter earnings and revenue that topped analyst estimates, investors focused on the company's muted growth outlook for 2026. The company's guidance for the full year implied only about 1% growth at the midpoint, which analysts at RBC Capital called "underwhelming." In response to the weak forecast, Citizens JMP Securities downgraded the stock to Market Underperform from Market Perform, citing "increasing competition" and concerns about a "persistent 90% net retention rate." RBC Capital and other firms also lowered their price targets on the stock.

Via StockStory · February 10, 2026

Shares of healthcare diagnostics company Quest Diagnostics (NYSE:DGX)

jumped 6.8% in the afternoon session after the company reported strong fourth-quarter financial results and offered an upbeat forecast for 2026. For the fourth quarter, Quest's revenue grew 7.1% year-on-year to $2.81 billion, surpassing analyst estimates. Its adjusted earnings of $2.42 per share also came in ahead of expectations. Looking forward, the company's full-year 2026 revenue guidance was a notable highlight, coming in 3.3% above consensus estimates. The earnings guidance for the upcoming year also topped forecasts, signaling management's confidence in sustained performance.

Via StockStory · February 10, 2026

Nvidia has lost $400 billion of market value so far in 2026.

Via The Motley Fool · February 10, 2026

AI is delivering impressive business results for these two giants.

Via The Motley Fool · February 10, 2026

The uranium miner still has a bright future.

Via The Motley Fool · February 10, 2026

MarketAxess operates a leading electronic platform for institutional bond trading, serving asset managers and broker-dealers worldwide.

Via The Motley Fool · February 10, 2026

With small-cap value stocks roaring back to life, this outperforming ETF is ready for its close-up.

Via The Motley Fool · February 10, 2026

Ecolab (ECL) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 10, 2026

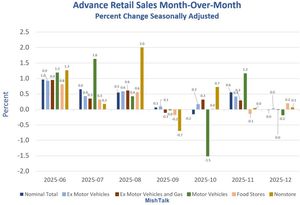

Economists missed the retail sales estimate for December by a mile.

Via Talk Markets · February 10, 2026