Southwest Airlines (LUV)

41.95

-0.49 (-1.15%)

NYSE · Last Trade: Jan 24th, 2:20 PM EST

Detailed Quote

| Previous Close | 42.44 |

|---|---|

| Open | 41.81 |

| Bid | 41.81 |

| Ask | 41.90 |

| Day's Range | 41.76 - 42.43 |

| 52 Week Range | 23.82 - 45.02 |

| Volume | 7,012,906 |

| Market Cap | 24.82B |

| PE Ratio (TTM) | 64.54 |

| EPS (TTM) | 0.7 |

| Dividend & Yield | 0.7200 (1.72%) |

| 1 Month Average Volume | 7,808,163 |

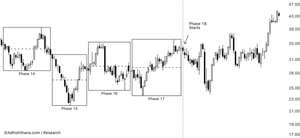

Chart

About Southwest Airlines (LUV)

Southwest Airlines is a major American airline that provides low-cost air travel services primarily across the United States and to select international destinations. Known for its no-frills approach, the airline emphasizes customer service, on-time performance, and a unique boarding process that allows passengers to choose their seats. Southwest operates a point-to-point transit model rather than a traditional hub-and-spoke system, allowing for greater flexibility and efficiency in its flight operations. The company has established a loyal customer base by offering competitive fares, no charge for checked baggage, and a straightforward pricing structure, making air travel more accessible to a broad range of travelers. Read More

News & Press Releases

The Chicago-based carrier, United Airlines Holdings Inc. (NASDAQ: UAL), reported record-breaking fourth-quarter and full-year 2025 financial results this week, signaling a permanent shift in the airline industry’s business model. On January 20, 2026, the company revealed that while its total revenue reached a historic $15.4 billion for the

Via MarketMinute · January 23, 2026

The bank’s head of equity strategy, Dubravko Lakos-Bujas, said that President Trump is likely to increase affordability efforts ahead of the midterm election season.

Via Stocktwits · January 23, 2026

As the 2025 fiscal year concludes, the aviation industry is witnessing a profound transformation in how profits are generated, with United Airlines (NASDAQ:UAL) standing at the epicenter of this shift. On January 23, 2026, the Chicago-based carrier reported fourth-quarter results that not only shattered revenue records but also highlighted

Via MarketMinute · January 23, 2026

SOUTHWEST AIRLINES CO (NYSE:LUV) Shows Strong Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · January 22, 2026

By Financial Research Analyst | January 23, 2026 As the global aviation industry enters a new era of "premiumization" and sustainability, American Airlines Group Inc. (NASDAQ: AAL) finds itself at a pivotal crossroads. Long characterized by its massive scale and equally massive debt load, the Fort Worth-based carrier has recently captured the market’s attention with [...]

Via Finterra · January 23, 2026

Introduction As of January 23, 2026, Southwest Airlines (NYSE: LUV) stands at a crossroads between its legendary past and a pragmatically modern future. Long regarded as the "maverick" of the skies, the airline spent much of 2024 and 2025 undergoing a fundamental identity shift. For decades, Southwest was defined by three things: open seating, "Bags [...]

Via Finterra · January 23, 2026

As of January 22, 2026, Delta Air Lines (NYSE: DAL) stands at a pivotal juncture in its century-long history. Having just concluded its centennial year in 2025, the Atlanta-based carrier has transformed from a traditional transportation company into a diversified "premium lifestyle" brand. While the broader airline industry has historically been plagued by razor-thin margins [...]

Via Finterra · January 22, 2026

The airline industry has always been a game of razor-thin margins and massive capital requirements, but for American Airlines Group Inc. (NASDAQ: AAL), the last two years have been a defining chapter in its nearly century-long history. Today, as American enters 2026, the carrier is at a pivotal crossroads. After a tumultuous 2024 defined by [...]

Via Finterra · January 22, 2026

As of January 22, 2026, Southwest Airlines (NYSE: LUV) stands at perhaps the most significant juncture in its 55-year history. Once the renegade of the skies that democratized air travel with low fares and a "no-frills" philosophy, the Dallas-based carrier is currently in the middle of a radical identity shift. With the official launch of [...]

Via Finterra · January 22, 2026

As we enter the third week of January 2026, the aviation industry finds itself at a pivotal juncture. Among the "Big Three" U.S. carriers, United Airlines (NASDAQ: UAL) has emerged as perhaps the most aggressive and strategically ambitious player in the post-pandemic era. Today, January 19, 2026, investors are laser-focused on United as the company [...]

Via Finterra · January 19, 2026

As the first weeks of 2026 unfold, the U.S. financial landscape is grappling with the aftermath of a historic milestone: corporate share buybacks officially surpassed the $1 trillion mark in 2025. This massive return of capital to shareholders has become the primary engine behind the S&P 500's resilience,

Via MarketMinute · January 16, 2026

Slimmer Waistlines, Fatter Margins: Jefferies Says Airline Companies Will Profit From America’s Weight-Loss Boomstocktwits.com

Via Stocktwits · January 14, 2026

The "K-shaped" recovery in the travel sector has reached a dramatic inflection point. On January 13, 2026, Delta Air Lines (NYSE: DAL) unveiled a fiscal year 2026 outlook that highlights a stark divergence in the American economy. While the carrier projected a robust 20% surge in annual earnings—targeting an

Via MarketMinute · January 14, 2026

In the high-velocity world of commercial aviation, Delta Air Lines, Inc. (NYSE: DAL) has transitioned from being a mere transportation provider to a premium consumer lifestyle brand. As of mid-January 2026, Delta stands as the most financially robust airline in the United States, having navigated a complex post-pandemic landscape with surgical precision. While the broader [...]

Via Finterra · January 14, 2026

Southwest Airlines (LUV) shows short-term strength, but our analysis reveals a weak triad structure, suggesting the rally may fade and range-bound trading is more likely.

Via Benzinga · January 14, 2026

ATLANTA — Delta Air Lines (NYSE: DAL) kicked off the fourth-quarter earnings season for the aviation industry today, reporting financial results that exceeded analyst expectations on the bottom line but failed to ignite investor confidence. Despite a record-breaking 2025 and a resilient premium travel market, the carrier’s stock tumbled more

Via MarketMinute · January 13, 2026

The U.S. aviation landscape shifted dramatically this week as two of the industry’s most efficient leisure operators announced a definitive merger agreement. On January 11, 2026, Allegiant Travel Company (NASDAQ: ALGT) and Sun Country Airlines Holdings, Inc. (NASDAQ: SNCY) revealed a $1.5 billion cash-and-stock deal aimed at creating a dominant, diversified leisure powerhouse. The market’s [...]

Via PredictStreet · January 13, 2026

ATLANTA — Shares of Delta Air Lines (NYSE: DAL) tumbled more than 5% on Tuesday after the carrier released its fourth-quarter 2025 earnings report. While the airline managed to post record annual revenue and narrowly beat earnings expectations for the final quarter of the year, a combination of cautious forward-looking guidance

Via MarketMinute · January 13, 2026

As of January 13, 2026, Delta Air Lines (NYSE: DAL) stands at a historic crossroads. Having just celebrated its centennial anniversary in 2025, the Atlanta-based carrier has transformed itself from a traditional legacy airline into what management describes as a "premium-first lifestyle brand." Today, Delta is in sharp focus following its Q4 2025 earnings release, [...]

Via PredictStreet · January 13, 2026

In a stunning display of resilience, the U.S. stock market surged to unprecedented levels on January 12, 2026, as both the S&P 500 and the Dow Jones Industrial Average (DJIA) notched fresh closing records. Investors appeared to decouple from a swirl of political and regulatory uncertainty, focusing instead

Via MarketMinute · January 12, 2026

As we enter the first day of 2026, Delta Air Lines (NYSE: DAL) stands at a historic crossroads. Celebrating its centennial year of operation, the Atlanta-based carrier has transitioned from a humble crop-dusting operation into the world’s most financially formidable airline. While the broader aviation industry has spent the last five years grappling with post-pandemic [...]

Via PredictStreet · January 1, 2026

The carrier’s stock closed at $44.52, rising 3.73% on the day.

Via Talk Markets · January 9, 2026

As the Fourth Quarter 2025 earnings season kicks into high gear this January 2026, Goldman Sachs (NYSE: GS) has issued a stark warning to institutional and retail investors alike: the market is significantly underpricing the potential for explosive stock price movements. Strategists at the investment bank argue that the "volatility

Via MarketMinute · January 9, 2026

Southwest Airlines (NYSE: LUV) shares surged to a three-year high on Friday, January 9, 2026, as investors aggressively positioned themselves ahead of the carrier’s most significant operational shift in its 55-year history. The stock climbed over 4% in early trading to hit $44.69, fueled by a rare "double-upgrade"

Via MarketMinute · January 9, 2026

In a dramatic shift of sentiment that has electrified the aviation sector, Southwest Airlines (NYSE: LUV) received a massive vote of confidence today as analysts at JPMorgan issued a rare "double upgrade" for the carrier. The move, which vaulted the stock from "Underweight" directly to "Overweight," comes at a critical

Via MarketMinute · January 9, 2026