As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at video conferencing stocks, starting with 8x8 (NASDAQ:EGHT).

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.8% since the latest earnings results.

Best Q3: 8x8 (NASDAQ:EGHT)

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ:EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

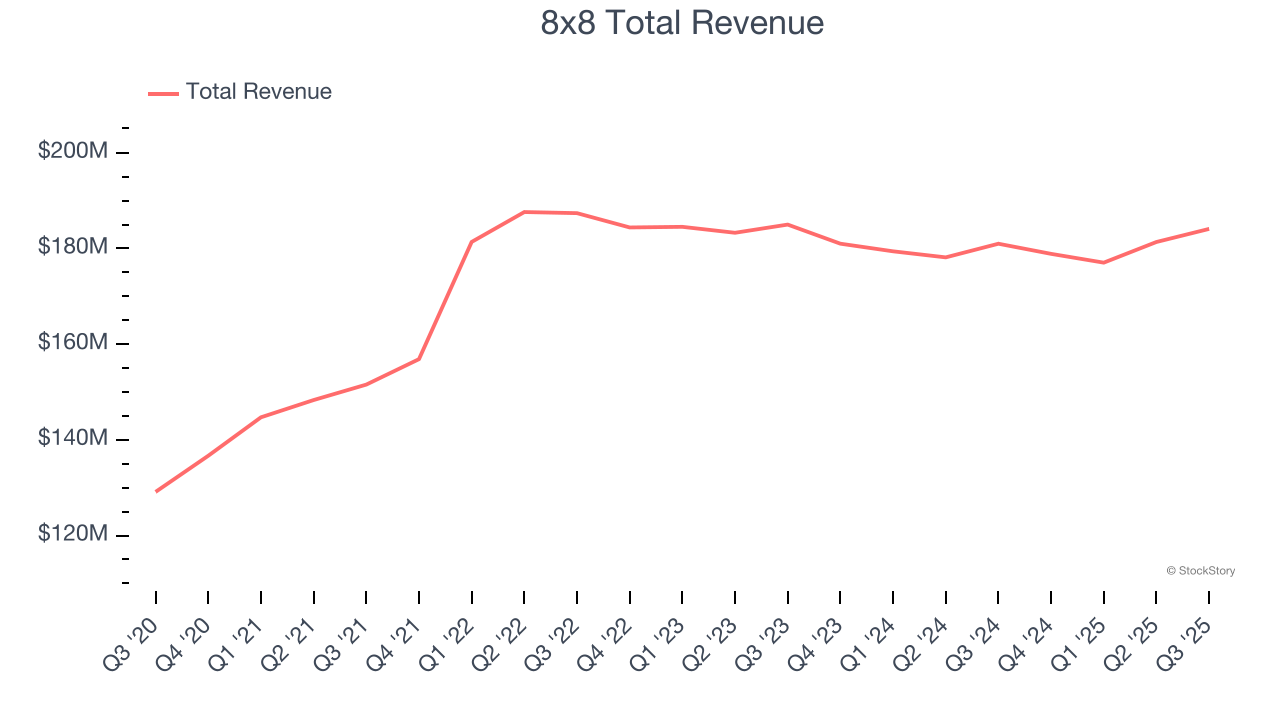

8x8 reported revenues of $184.1 million, up 1.7% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

“Our second quarter performance reflected progress against our strategic priorities,” said Samuel Wilson, Chief Executive Officer at 8x8, Inc.

8x8 scored the biggest analyst estimates beat but had the slowest revenue growth and slowest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 5.9% since reporting and currently trades at $1.68.

Is now the time to buy 8x8? Access our full analysis of the earnings results here, it’s free.

Zoom (NASDAQ:ZM)

Once the verb that defined remote work during the pandemic ("let's Zoom later"), Zoom (NASDAQ:ZM) provides a cloud-based platform for video meetings, phone calls, team chat, and collaboration tools that helps businesses and individuals connect virtually.

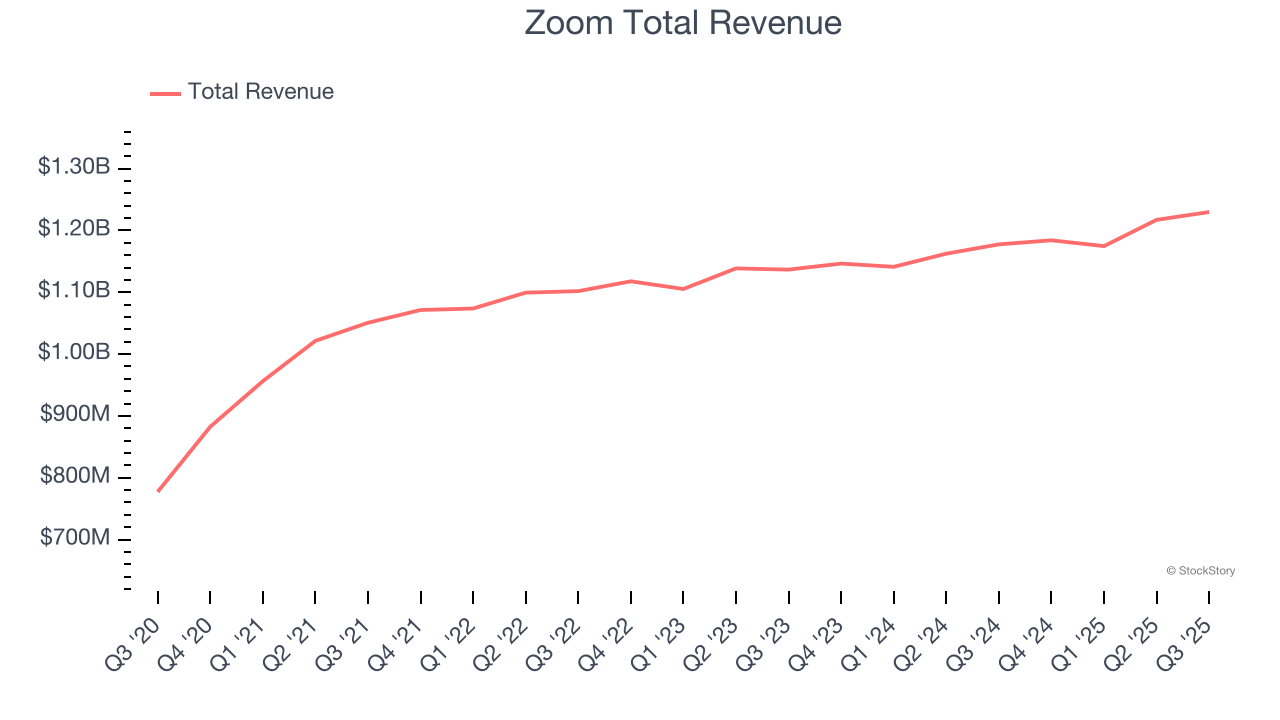

Zoom reported revenues of $1.23 billion, up 4.4% year on year, outperforming analysts’ expectations by 1.3%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and EPS guidance for next quarter beating analysts’ expectations.

Zoom scored the highest full-year guidance raise among its peers. The company added 89 enterprise customers paying more than $100,000 annually to reach a total of 4,363. The market seems content with the results as the stock is up 3.9% since reporting. It currently trades at $81.64.

Is now the time to buy Zoom? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: RingCentral (NYSE:RNG)

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral (NYSE:RNG) provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

RingCentral reported revenues of $638.7 million, up 4.9% year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and billings in line with analysts’ estimates.

As expected, the stock is down 13.2% since the results and currently trades at $25.98.

Read our full analysis of RingCentral’s results here.

Five9 (NASDAQ:FIVN)

Taking its name from the "five nines" (99.999%) standard for optimal service reliability in telecommunications, Five9 (NASDAQ:FIVN) provides cloud-based software that enables businesses to run their contact centers with tools for customer service, sales, and marketing across multiple communication channels.

Five9 reported revenues of $285.8 million, up 8.2% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Five9 delivered the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 19.7% since reporting and currently trades at $17.42.

Read our full, actionable report on Five9 here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.