Over the past six months, Cisco has been a great trade. While the S&P 500 was flat, the stock price has climbed by 20.2% to $60.80 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Cisco, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why there are better opportunities than CSCO and a stock we'd rather own.

Why Do We Think Cisco Will Underperform?

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ:CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

1. Long-Term Revenue Growth Flatter Than a Pancake

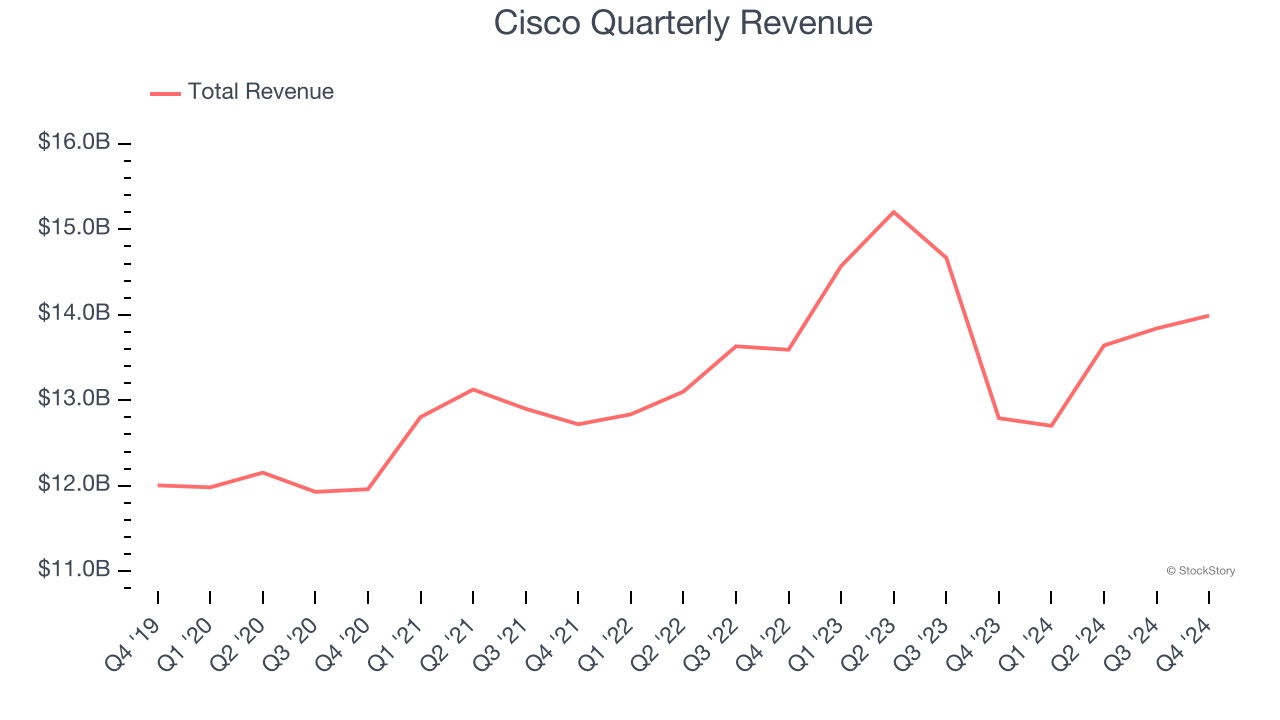

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Cisco struggled to consistently increase demand as its $54.18 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a low quality business.

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

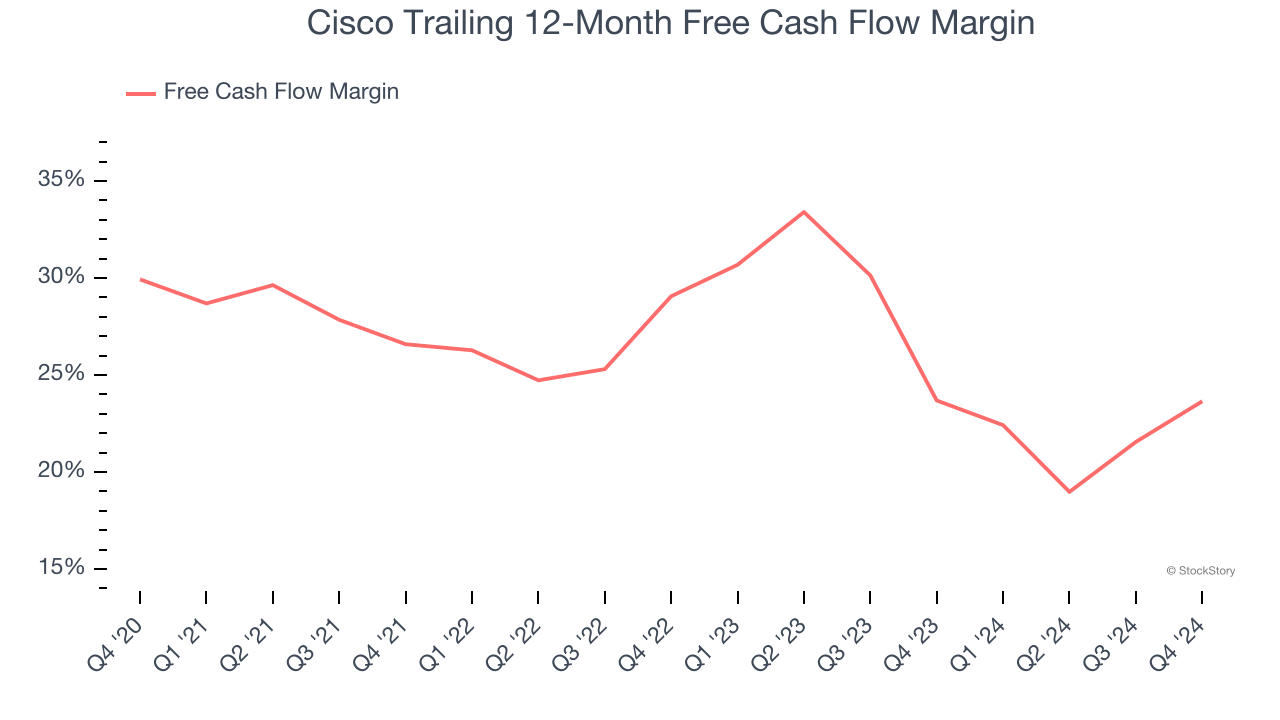

As you can see below, Cisco’s margin dropped by 6.3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Cisco’s free cash flow margin for the trailing 12 months was 23.6%.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Cisco’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Cisco falls short of our quality standards. With its shares outperforming the market lately, the stock trades at 16.1× forward price-to-earnings (or $60.80 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Cisco

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.